hpo Spotlight

Customer orientation in banking: success factors

Banks are future viable if they put their customers back at the center of their activities – without ifs and buts. By consistently aligning value proposition, product and service portfolios, process, and organisational structures, and employees with their customers. hpo Insights shows how to tackle this.

Share article

Consistent customer orientation as an economic imperative - also for banks

Changed general conditions

The banking environment is shaped by various influencing factors and trends. These include regulatory requirements, the competitive situation, but also customer satisfaction or technological developments. Observers even speak of a veritable crisis of purpose in which the banking business model finds itself:

Dissatisfied clients and those willing to switch

Studies in Switzerland and neighbouring countries show a relatively high proportion of dissatisfied bank clients. Among other things, this can be attributed to a gap between client needs and the actual services offered. The per capita earnings of dissatisfied customers are significantly lower than those of particularly satisfied account holders, who purchase more products, stay longer with the institution and recommend it more often.

Strategic need for action

Our observations show that many banking institutions are prioritising automation in order to increase their efficiency. In order to strengthen the future viability of a company, it is necessary to find the right balance between cost optimisation and investments. This includes decisions on:

- Target customers,

- product and service portfolios,

- distribution channels,

- process organisation

All this contributes to increasing efficiency and generating growth again. Finally, the mobilisation and qualification of employees also plays a central role in the upcoming transformation tasks of banks.

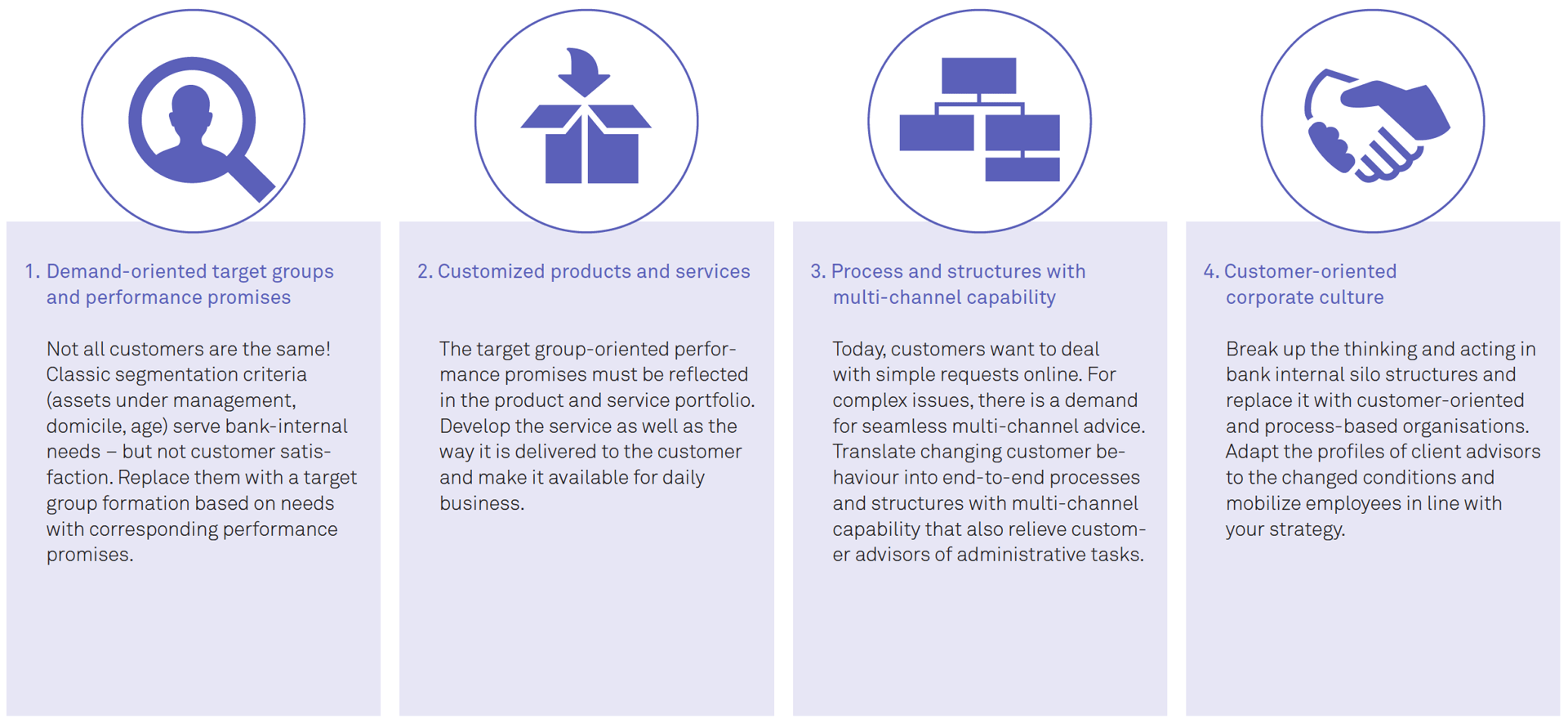

4 Success factors of customer orientation

Success factor 1: Need-based target groups and value propositions

Classic segmentation criteria (assets under management, domicile, age) serve internal bank needs - but not customer satisfaction. Replace them with needs-based target group formation with corresponding value propositions.

Design philosophy hpo

- Not all customers are the same!

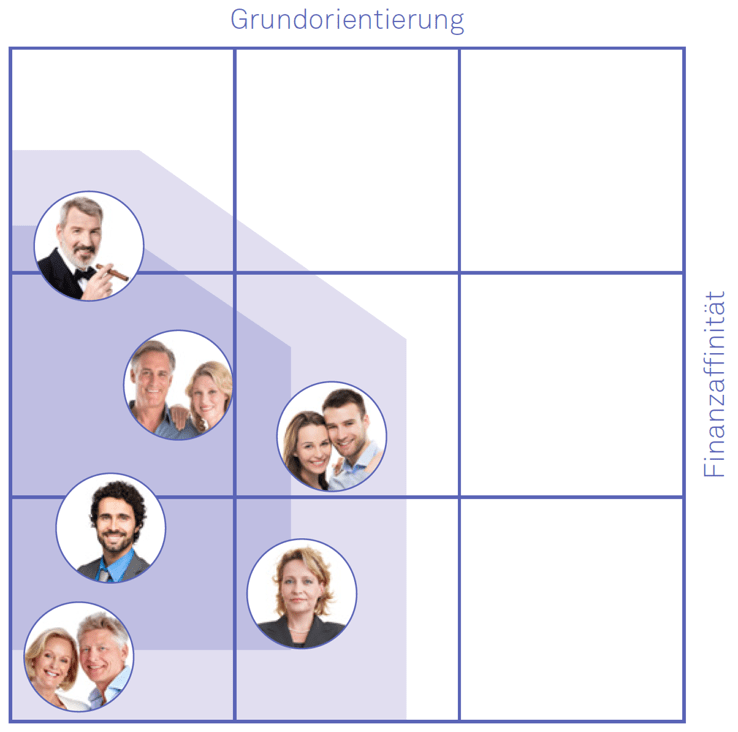

- By combining factors that influence the behaviour of bank customers, homogeneous target groups can be identified through personas.

- The needs of bank customers are influenced by, among other things:

- their basic orientation (values)

- their financial affinity (knowledge and interests) and

- the origin of their assets (heir, entrepreneur, employee).

By analysing the customer journey, the customer's "journey" to satisfy a need, direct and indirect contact points (so-called "moments of truth" or "pain points") can be identified, described and differentiated according to personas.

Practice-proven approach

- Understanding of current customer segmentation

- Hypothesis-driven design of needs-based target groups and value propositions:

- Description of different personas as representatives of target groups

- Customer journey workshops with customer advisors and segment and product managers to identify the needs and requirements of these personas

- Derivation of target group-specific value propositions in response to customer expectations

- Test the project results with bank customers as representatives of the described personas in order to uncover any internal thinking errors

Customer value

Increased customer satisfaction by identifying customer needs per customer segment and deriving a customer-oriented value proposition:

- stronger customer loyalty

- higher share-of-wallet per customer

- More new customer acquisition through positive word-of-mouth advertising

Success factor 2: Customised products and services

The target group-specific value propositions must be reflected in the product and service portfolio. Develop the performance as well as the type of performance reference in a customer-specific way and make it available for day-to-day business.

Elements of the innovation engine

Design philosophy hpo

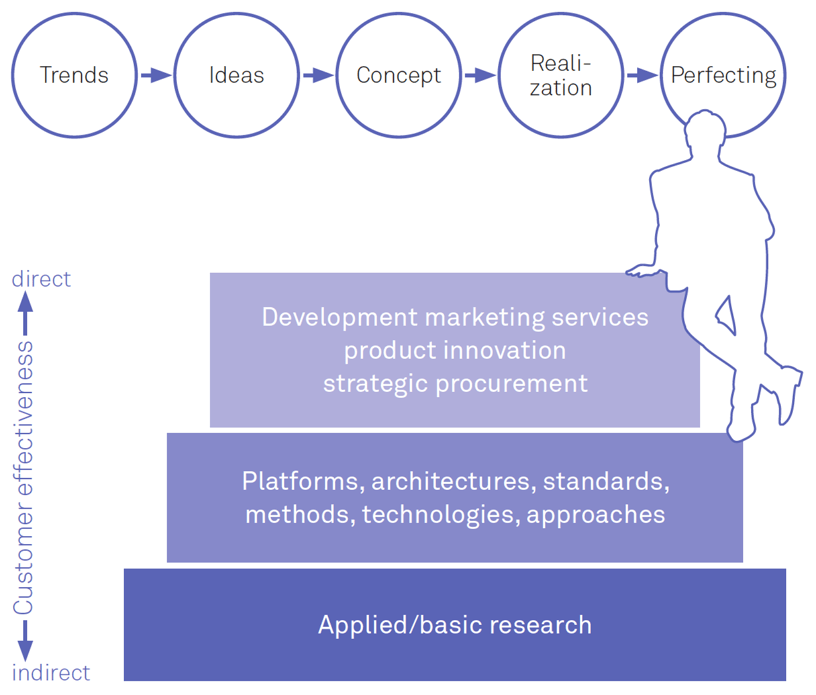

- Innovation is an essential driver for organic growth of companies.

- In our understanding, innovation includes all activities that enable a company to offer new products and services to customers in the future, to develop necessary competencies and to further develop the company in general.

- In order for banks to be able to offer their customers products and services that meet their needs in the future, they must firstly understand their future needs, derive value propositions from them and build up the necessary capabilities for different innovation levels (fundamentals - technologies - products and services) or buy them in via partners and secondly implement innovation structures that are different from the day-to-day business and enable portfolio-based innovation that is also lived thanks to user-friendly tools.

Practice-proven approach

- Analysis of the future needs of the target groups and the perceived value of the bank's services

- Design of the market service architecture derived from this (services to be generated in the day-to-day business and the necessary preliminary services)

- Design of the innovation architecture, which describes the capabilities for the (further) development of the company and its services.

- Construction of an innovation machine (process model with stage-gate logic for controlling specific innovation processes) and anchoring in the organisation Digitisation of the innovation machine with the help of a user-friendly management tool

Customer benefits

Customised products and services:

- Massively shortened time-to-market with innovations that are relevant from the customer's point of view

- Increased innovative strength through transparency, manageability and measurability of innovation processes

- Decision-making basis for prioritising projects and targeted budget allocation

Success factor 3: Multi-channel-capable process and organisational structures

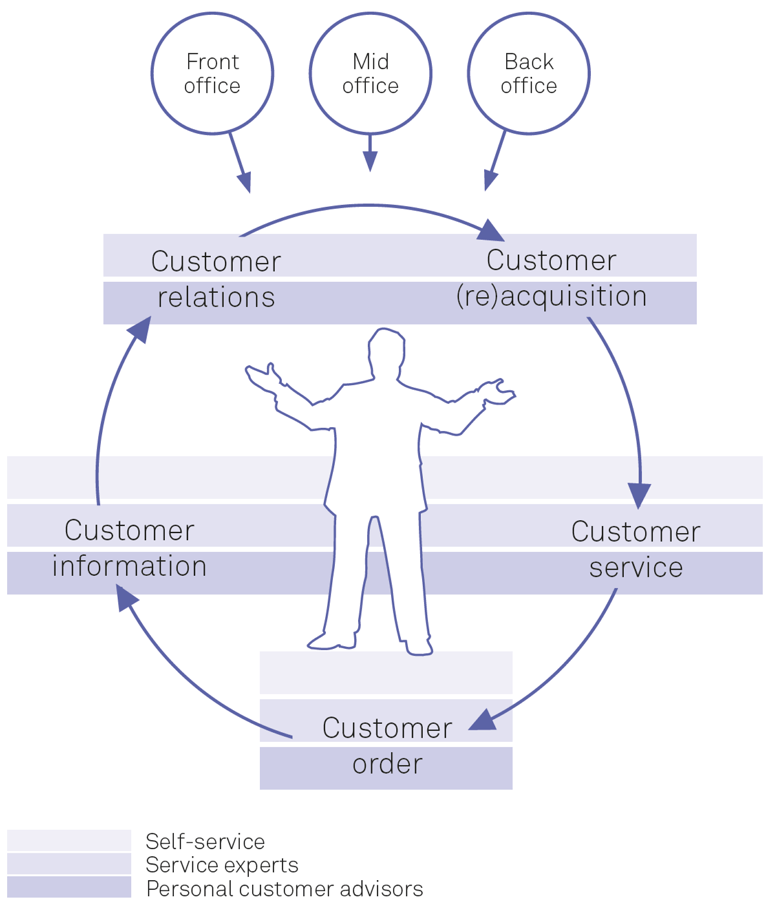

Customers already want to deal with simple issues online. For complex issues, they ask for seamless multi-channel advice. Translate the changing customer behaviour into multichannel-capable end-to-end process and set-up structures that also relieve the customer advisors of administrative tasks.

Design philosophy hpo

- The first step is to understand the relevant customer segments, their needs, the value proposition and the services derived from it (products, services, inputs).

- Subsequently, the activities are defined that are absolutely necessary along the customer life cycle in order to create this performance.

- According to the required competences, these activities are "cascaded" and "segmented" in order to create

- consistent and measurable end-to-end responsibilities,

- clearly defined interfaces and

- process variants appropriate to the business case

- Finally, the processes are anchored in the organisation.

Tried and tested procedure

- Analysis of current services, roles and responsibilities of front, mid and back office areas of the bank along the customer life cycle

- Analysis of business area strategies and representative business cases Design of a multi-channel and competence-based business process model to increase customer orientation and thus sales effectiveness and efficiency

- Development of a pilot concept for an optimised customer care process to relieve customer advisors of administrative tasks

- Rollout with support through individual change management

Customer benefits

Functioning multi-channel access through expanded self-service offerings, access to available service experts and personal customer advisors:

- Exploitation of revenue potential through increased customer satisfaction

- Increased cost competitiveness through optimal service delivery

Success factor 4: Customer-oriented corporate culture

Break down thinking and acting in bank-internal silo structures and replace them with customer-oriented and process-based organisations. Adapt the profiles of client advisors to the changed framework conditions and mobilise employees in line with your strategy.

Design philosophy hpo

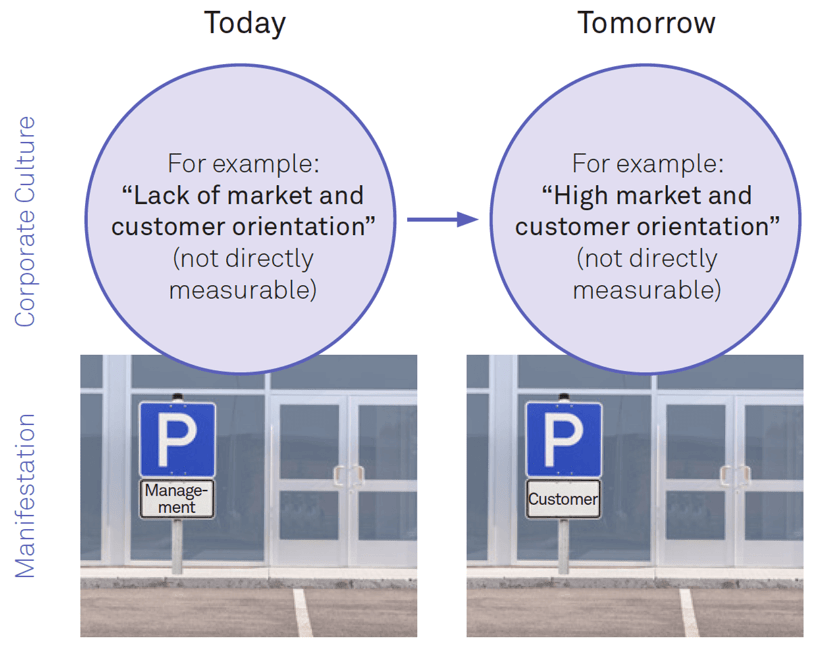

- Corporate culture is the set of shared values, norms and attitudes that shape the decisions, actions and behaviour of organisational members.

- Manifestations of culture can be changed and thus new values and attitudes can be anchored in the organisation.

- Individual measures to achieve the desired corporate culture (for example, "high market and customer orientation") can be consolidated into action areas that can be implemented, communicated and controlled.

Field-tested procedure (example)

A major bank integrated two sales organisations with very different cultures into a powerful new unit through strategy-based cultural change. Top management was involved in the process through interviews and about 10% of the employees through cultural workshops. From this, significant fields of action were derived in which a common target culture was established through a targeted change of so-called "material manifestations", which optimally supported the new strategic direction. This included, for example, defined career models or new advisory processes with a clear professional and management model as well as a more focused way of working with a higher client contact rate.

Customer benefits

Improved customer experience through professional advice and support from motivated and qualified bank employees as a prerequisite for successful implementation of the strategy by employees understanding it and initiating and supporting concrete change projects.

Your strategy and organisation consultancy

Who is hpo management consulting?

hpo stands for High Performance Organisations. As experts for strategy, business processes, organisation and transformation, we have been supporting nationally and globally active clients since 1995 in releasing performance potential and transforming strategies into measurable results. With our holistic and partnership-based enterprise desing approach, we reliably lead them to their goal: a consistently designed and sustainably effective High Performance Organisation - fit for the future and with a clear competitive advantage.

hpo - unlocking performance