hpo Spotlight

From farming to hunting: CI in retailbanking

Retail banking is changing. Digitalisation is paving the way for the development of new channels, products are becoming more standardised, customers are becoming more independent and their expectations of retail banking are changing as a result. How can the use of customer intelligence unleash potential?

Share article

The role of the client advisor is changing

Traditional approaches to customer care and the role of sales must be rethought and adapted. The sales-supporting use of acquired customer data through the use of customer intelligence (CI) in potential identification not only enables efficiency gains, but also ensures situation-specific support by the appropriate advisor. The advisor is increasingly evolving from farmer to hunter. Such changes must be anchored sustainably and consistently in the operational and organisational structure.

Market changes

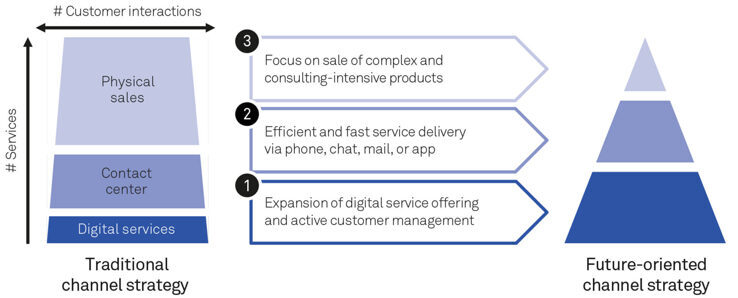

The market environment in retail banking is changing. Traditional sources of income are eroding, and measures to increase efficiency are indispensable. Personal customer advisory services are cost-intensive and must therefore be used in a very targeted manner. At the same time, digitalisation is changing customer behaviour and - very importantly - customer needs. Customers are increasingly conducting their financial transactions independently online and visit branches less frequently. Thanks to product standardisation, advice from a personal client advisor is often no longer needed, and the contact centre for simple client concerns is also gaining acceptance among wealthy clients.

Client advisors can therefore focus primarily on complex client concerns. It is precisely for these concerns that clients today expect highly professional as well as personalised advice. The ability to emotionalise the counselling interview as well as expert knowledge are moving to the forefront, displacing the importance of building a long-term relationship. Due to the reduced proximity to the customer, however, it is essential to intelligently evaluate the available customer data and in this way anticipate customer needs. In this way, the customer can be contacted personally at the right moment via the right channel and on the relevant topics, and be looked after according to his or her needs.

Market changes

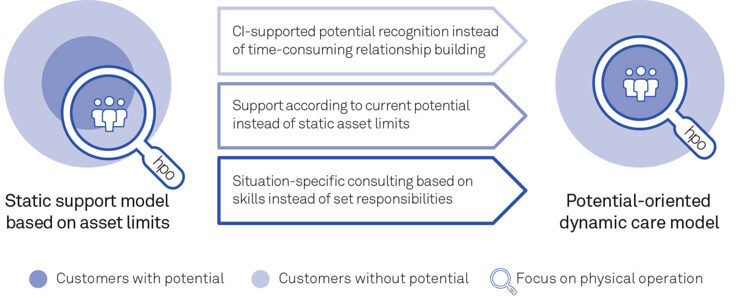

Potential orientation in sales

Traditional static relationship management models, in which clients are classified and managed according to their assets, are no longer appropriate in retail banking. Clients are managed in portfolios, i.e. assigned to an advisor, without clients explicitly expecting this. In such a service model, the assigned advisor is responsible for all client concerns as well as the portfolio analysis and invests a lot of time in maintaining the client relationship.

In dynamic care models, the efficiency of customer care can be significantly increased through the use of customer intelligence (CI). The data-driven identification of potential encompasses the entire customer base and is no longer limited to those customers with whom the bank is currently in contact. Leads generated by CI become the central sales instrument in potential-oriented, dynamic support.

In accordance with the strategic orientation, data evaluation campaigns are programmed that provide the appropriate client advisor with leads according to defined criteria and thus provide him with information on a possible sales opportunity. In this way, the client advisor can target clients with potential and focus his advisory services on those topics that have a high probability of closing a deal. This ensures that the client receives the best possible advice with regard to his individual concerns.

Flexibility in cross-channel customer allocation is of great importance for the success of such a dynamic service model. The interaction of the different channels and organisational units must be clearly regulated and anchored in the processes. The role of the advisor and thus the required skills are changing. Instead of the classic customer relationship management on a limited customer base (farming), advisors must address a much larger number of customers based on leads and process them without relationship history (hunting).

CI-supported working methods are not just an IT issue

Successful anchoring in the organisation

In order to successfully implement a dynamic support model and a CI-supported way of working, the following prerequisites must be created:

- Orientation of customer advisory services towards tapping identified potential ("hunting") and anchoring in the sales business process model.

- Alignment of the sales channels and their responsibilities on the basis of the new business process model and creation of a continuous flow of data information.

- Changed sales management - away from fixed sales targets to dynamic, lead-based target setting

- Initiation of a mindset shift among customer advisors and strengthening of their ability to quickly inspire customers and emotionalise sales conversations, even without the basis of a long-term personal customer relationship.

- Structured preparation of business and customer data as a high-quality data basis and development of data analytics competence

- Further development of the appropriate CRM and advisor tools to optimally support the client advisors in the new way of working

Customer Intelligence supported way of working

The change to a CI-supported way of working cannot be reduced to an IT issue. In order to achieve the desired increase in efficiency without loss of sales, the significant changes in the support model and the way of working must be anchored in the processes as well as in the organisational structure. Thanks to hpo's integral consulting approach, we can support you in successfully implementing a consistent realignment of sales.

Your strategy and organisation consultancy

Who is hpo management consulting?

hpo stands for High Performance Organisations. As experts for strategy, business processes, organisation and transformation, we have been supporting nationally and globally active clients since 1995 in releasing performance potential and transforming strategies into measurable results. With our holistic and partnership-based enterprise desing approach, we reliably lead them to their goal: a consistently designed and sustainably effective High Performance Organisation - fit for the future and with a clear competitive advantage.

hpo - unlocking performance